“I got a great price, reasonable price… the process was seamless… the best experience I’ve ever had!”

Inheriting a property adds a layer of complexity to the selling process.

It can be a whirlwind of emotions, legalities, and practicalities. Unlike a standard home sale, you might be facing:

These are all valid questions, and it’s perfectly normal to feel overwhelmed.

Selling inherited property can involve unfamiliar legal and financial processes, on top of the emotional toll of parting with a place that likely holds sentimental value.

You might be wondering how to determine the fair market value of the property, what kind of repairs (if any) are necessary, and how to navigate the logistics of showings and closing procedures.

On top of that, there’s the potential for disagreements with family members who may have different attachments to the property or ideas about how to proceed.

But fear not! This guide will be your roadmap to a smooth sale. We’ll address these concerns (and more!), so you can confidently navigate the process of selling your inherited property.

Here’s everything you need to know to get started.

Navigate the Sale: Essential Information for Inherited Properties

By understanding the key aspects of selling an inherited property upfront, you’ll be better positioned to make informed decisions throughout the process. You will:

Estate Tax on Inherited Property: What You Need to Know

When selling inherited property, keep in mind these three potential taxes:

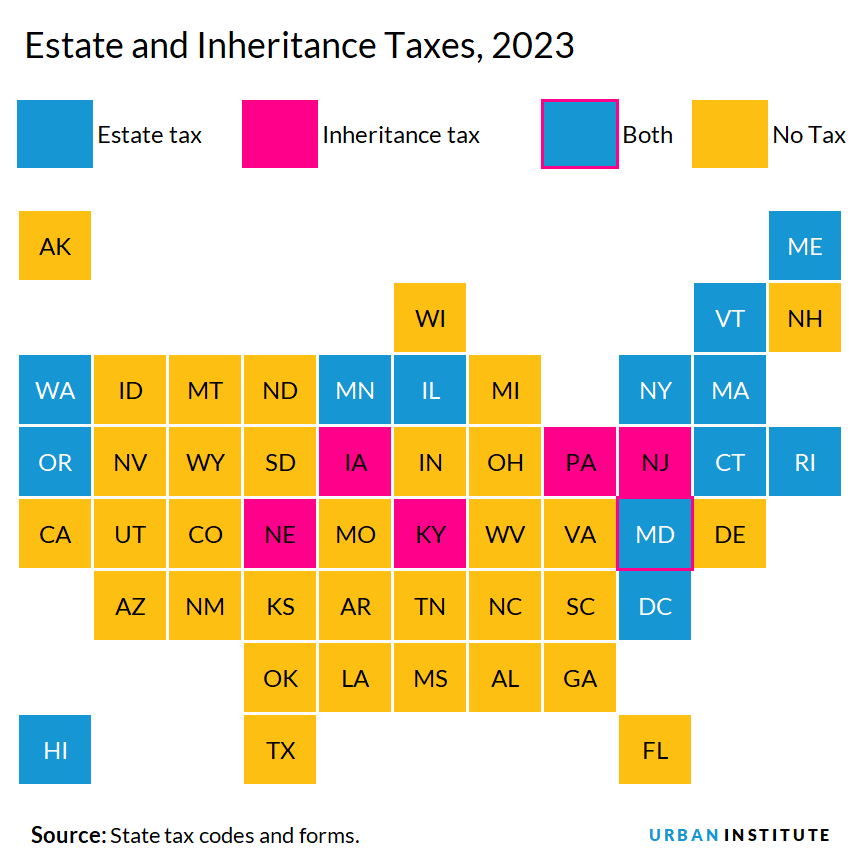

As you can see in the chart below, only some states implement inheritance or estate taxes:

In the case of Idaho, neither inheritance nor estate taxes are applied.

In addition, beneficiaries inheriting from a deceased spouse are usually exempt from inheritance taxes. This exemption often applies to children as well, but it can vary depending on location and the size of the inheritance.

Estate taxes are uncommon since they only apply to very large estates exceeding $13.61 million (as of 2024).

Inheriting property is great, but what about selling it? The tax you’ll likely need to consider is…

Capital gains.

Capital gains tax

Imagine you buy something for a certain amount, then later sell it for more. The difference between the buying and selling price is your capital gain. Capital gains tax is the tax you pay on that profit.

That’s right, when you inherit a home and then sell it, the original purchase price doesn’t factor into your capital gains tax. Instead, a different value is used for tax purposes. This is a benefit of inheriting property!

To help with capital gains taxes on inherited assets, the IRS allows you to use a “stepped-up cost basis.”

Instead of using the original purchase price, a concept called “step-up in basis” resets the cost of an inherited asset to its fair market value on the date the owner passed away. This new value becomes the asset’s cost basis for tax purposes.

To get a precise idea of fair market value, we can use an appraisal. We’ll delve into this process shortly.

Example: Calculating Capital Gains Tax on the Sale of My Inherited House

Considering inheriting a home and selling it?

The property my parents bought for $200,000 had significantly appreciated in value. By the time they passed away, it was worth a staggering $1 million.

If we estimate a selling price of $1,100,000…

Instead of considering a gain of $900,000, you’d subtract the current value of the asset (its cost basis) at $1,000,000 from the selling price of $1,100,000 to determine the taxable gain.

Hypothetically, let’s say the expenses total $65,000.

When you sell the asset, you’ll realize a capital gain of $35,000. This is because the selling price ($1,100,000) minus your purchase price ($1,000,000) and closing costs ($65,000) equals a profit of $35,000. You will owe capital gains tax on this profit.

The amount depends on how much money the estate, trust, or you have coming in.

Inherited property gets special tax treatment. You won’t owe capital gains tax on the increase in value before you inherited it.

Federal income tax rates range from 0% to 20%.

If your business expenses are greater than your income, you can report that loss on your tax filings.

To make sure you’re on the right track, it’s always a good idea to chat with a tax pro about your specific situation.

Understanding Probate for Property Inheritance

Probate is the court-supervised procedure that ensures a deceased person’s assets are handled properly. This includes identifying the rightful inheritors, paying off any debts, and distributing the remaining belongings according to the deceased’s wishes (if a will exists) or state law (if there’s no will).

This process is usually used when someone dies without a will to say who inherits their belongings.

In two main scenarios, an inherited home can avoid probate:

If you are named as a beneficiary of real estate in a will…

This triggers the probate court, unless steps were taken to bypass it.

While this process is simpler and faster, managing an estate without a will involves probate court, which can be lengthy and complex.

Finding the right real estate partner: Considerations beyond attorney referrals

Estate attorneys sometimes provide referrals for listing agents when clients inherit property. Estate attorneys often collaborate with real estate agents to assist clients who inherit property and need to sell it.

This means the attorney and agent engage in a reciprocal referral arrangement.

What is the significance of this? In what way is this important?

Because a real estate agent recommended by an attorney might not be the person best qualified to sell the property.

We can’t rule it out entirely.

While qualifications are essential, an ideal business partner possesses additional strengths you should seek out.

These will be explained shortly.

Navigating the Sale of Your Inherited Home

Knowing the steps of selling an inherited home can make the process smoother.

By handling each step correctly, you’ll be well-positioned to make the most of your inheritance in a short time.

So… Thinking of Selling an Inherited House? Here are the steps to follow:

1. Determine an Estate’s Value with a Date of Death Appraisal

Inheriting a house? A time-of-death appraisal is the crucial first step before selling.

An appraisal done at the time of death (also called a “date of death appraisal”) establishes a home’s value when the owner passed away.

This receipt will be helpful when you file your taxes.

The appraised value becomes the cost basis when you sell, affecting your capital gains tax.

The IRS recommends getting a date of death appraisal done within six months following a person’s death.

An appraisal by a qualified professional is required.

There are two approaches to getting a date of death property valuation.

Don’t throw away the appraisal. Keep it for your personal records and potentially for filing future tax returns.

2. Collect your belongings

Clearing out an inherited house is a necessary step before selling, but it can be quite demanding in terms of both time and emotional energy.

This is especially important to consider if you’re inheriting and selling a house after a parent’s death.

It’s actually one of the most important things.

Why?

Creating a setting that allows potential buyers to visualize their future here.

With clutter everywhere, it’s much harder for them to pretend nothing is wrong.

These tips will help you with the removal process:

3. Find your perfect real estate match

Having the right real estate partner on your side can be key to making smart decisions with your inheritance.

Here are some important factors to keep in mind when choosing a real estate partner to sell the home you inherited:

We buy houses in ANY CONDITION in Idaho. There are no commissions or fees and no obligation whatsoever. Start below by giving us a bit of information about your property or call (208)314-1350…

4. To Renovate or Not to Renovate: Selling Strategies for Your Property

Giving an inherited house a facelift with fresh paint and landscaping can boost its appeal to buyers.

Inheriting property doesn’t always mean someone can afford to keep it.

The opinions of family members and beneficiaries may diverge.

One effective way to handle inherited property is…

Connect with the parties involved in the home sale.

We need to reach a consensus on the best course of action for the property: invest in improvements or proceed with an as-is sale.

If you decide to make improvements, your realtor can help you develop a plan to maximize their impact on the sale.

Focus on improvements that will increase your earning potential.

Avoid unnecessary repairs to save time and money when selling your house.

Look for an agent with experience and a proven track record to ensure you get reliable advice.

To ensure a smooth sale, it is essential to establish alignment among all beneficiaries regarding the approach to preparing the home for marketing.

5. Set the Strategic Listing Price

Don’t underestimate the importance of listing your property at the right price.

Overpricing a house is the main reason it lingers on the market.

On the other hand, underpricing an inherited asset leads to a lower sale price.

This is a critical step in the process, so let’s make sure to get it right.

A comparative market analysis helps estimate your home’s value by looking at similar houses sold nearby.

The catch is…

To determine the fair market value of a property, adjust the base price based on the pros and cons of its key features compared to similar properties.

To determine an accurate price, we must account for the value added or subtracted by variations in square footage, lot size, condition, noise factors like traffic, and the quality of nearby schools.

Having a professional analyze the market will provide a neutral estimate of the home’s worth. This unbiased valuation can serve as a common ground for all beneficiaries to reach a fair agreement.

6. Secure the Right Deal Through Negotiation

Inherited House Receives Offer… Now what?

But It Might Also Be Nerve-Racking”

Offer Received! It’s time to discuss details

Here are a few things you’ll want to pay attention to:

If other parties are inheriting this asset, it’s important to share the details of the buyer’s offer with them now.

Be prepared for different reactions. People might have varying opinions on this.

Informed decision-making is key to avoiding disagreements later. Ask your agent to provide a pros and cons analysis of the offer.

Work with your real estate agent and any other involved parties to decide whether to accept, reject, or counter the buyer’s offer.

7. Move Forward with Confidence

After you accept an offer, there are a few things to check off your list to ensure a smooth transition to your new role.

These include, but are not limited to:

Your agent should proactively manage these matters and provide you with regular updates on their progress.

The person who receives the assets after someone’s death, either named in a will or designated in a trust, will be responsible for signing the final documents.

The smooth flow of a real estate transaction is ensured through close collaboration between the real estate agent and the escrow company.

Sealing the deal happens when the grant deed is filed with the appropriate county.

Upon closing, the escrow company will disburse the funds to you within 24 hours, usually via wire transfer or cashier’s check. (Disburse means to pay out).

Next steps after selling an inherited property

Now that you’ve sold your inherited house, here are some important next steps.

What you need to do depends on your situation, but doing it can help you avoid financial problems and legal trouble.

Reduce Tax Stress & Save Money

Inheriting a house raises concerns about capital gains tax implications for sellers.

Here’s how to complete this in 3 steps:

Allocate estate proceeds to beneficiaries

Fairness, transparency, and legal compliance are essential for all distributions.

It’s important to consider the context so they don’t seem forced.

It is advisable to first inform any additional beneficiaries of their inheritance details, including the amount they will receive and the timeframe for distribution.

Taking the time to discuss profit sharing upfront fosters a harmonious outcome.

If the property belonged to an estate or trust with several beneficiaries, follow the distribution instructions in the governing document (will, trust, or estate plan).

In the absence of a distribution plan, inheritance laws apply.

Complete this step fairly and impartially to prevent any future disputes between heirs or beneficiaries.

Finalizing the Distribution of Assets

If the property was sold as part of an estate settlement, there might be additional steps involved in the buying process.

Here’s what you gotta do:

Tips for selling an inherited house

Achieving a smooth and profitable sale for your inherited property requires a strategic approach. Let’s explore some helpful tips…

Unlock your success with these valuable tips!

Non-Mandatory Seller Disclosures: What to Consider

In most places, sellers must disclose specific information about a home’s condition before it can be sold.

There may be slight variations by state, but these forms are largely consistent nationwide.

Disclosures ask homeowners a series of questions to get specific details about the property.

Inheriting a house and then selling it comes with some unique considerations.

Because the property wasn’t their main home recently, sellers who inherit it are typically exempt from answering certain questions about its condition.

These questions can be challenging to answer.

Why?

Full disclosure is key to avoid legal complications later.

The new owner may have legal recourse if they believe there were inaccuracies in the completed forms.

Just answer the questions directly and don’t share any unnecessary information.

Consulting with a real estate professional is highly recommended.

Establish a clear plan with family members

Inherited property can be a source of conflict, even among relatives.

Let’s ensure everyone’s aligned from the start to avoid major disagreements down the road.

The key to success is a well-defined strategy that incorporates…

So, what now?

While inheriting a house and then selling it might appear complex, it can actually be rather simple.

Consider this guide your compass as you chart your course through the steps.

The secret to achieving your goals lies in choosing the right approach and having a knowledgeable business partner to guide you.

Would you like assistance with the process?

Thinking of selling an inherited property? We offer a no-cost, no-obligation cash offer and connect you with a local investor experienced in handling inherited property sales.

Testimonials

“I got a great price, reasonable price… the process was seamless… the best experience I’ve ever had!”

“You guys did what you said you just gonna do. I have no complaints. We get it done!”

“They responded very quickly, and we were able to sell the house in a matter of a couple of weeks.”

We are a real estate solutions and investment firm that specializes in helping homeowners get rid of burdensome houses fast. We are investors and problem solvers who can buy your house fast with a fair all cash offer.

© 2025 Boise House Buyers - Powered by Carrot